Blog

Sam Altman Just Confirmed What We’ve Been Saying All Along

Big Tech’s AI partnerships hinder competition and slow innovation. The FTC should investigate them.

Highlights

- OpenAI’s leadership now sees Microsoft’s $13.75 billion “partnership” as over-reaching and is weighing whether to ask regulators to probe the company for anticompetitive practices.

- The FTC’s January 2025 study shows how cloud giants (Microsoft, Amazon, Alphabet) gain equity, board seats, spending lock-ins, and deep data/engineering access.

- Meta’s 49%, $14.3 billion stake in Scale AI mirrors Microsoft-OpenAI.

- The FTC should investigate how such cross-ownership softens competition and delays disruptive innovation that can challenge today’s Big Tech companies.

For years, Big Tech has claimed that its massive investments in AI startups are about “partnerships” and “innovation.” But that myth isn’t holding up as we learn more about what’s really happening behind the scenes. According to The Wall Street Journal, the relationship between OpenAI and Microsoft has gotten so contentious that OpenAI’s executives have discussed what they view as a nuclear option:

Accusing Microsoft of anticompetitive behavior during their partnership, people familiar with the matter said. That effort could involve seeking federal regulatory review of the terms of the contract for potential violations of antitrust law, as well as a public campaign, the people said.

Yes—even Sam Altman has finally come to terms with the reality that OpenAI’s deal with Microsoft is anticompetitive and gives Microsoft too much control over how OpenAI operates its business.

It’s a stunning admission from the company that Microsoft has propped up to the tune of $13.75 billion. Their partnership has made Azure the default cloud infrastructure for nearly all OpenAI products and has given Microsoft a privileged view into everything from model training to deployment.

According to the FTC’s January 2025 report (Partnerships Between Cloud Service Providers and AI Developers), these partnerships also give Microsoft exclusive rights, preferential treatment, and access to internal data and engineering teams—effectively turning “independent” startups into captive subsidiaries. As the FTC report lays out in extensive detail, these investment agreements give cloud service providers (i.e. Alphabet, Amazon, Google) significant de facto control over their “partners.”

- CSPs gain major equity stakes and revenue-sharing rights in their AI partners, with the potential to fully acquire them later.

- CSPs receive special privileges like board seats, consultation, and exclusivity, giving them influence over the AI developers’ decisions and operations.

- AI developers must spend much of the investment they receive on the CSP’s own cloud services, creating a loop that minimizes the CSP’s financial risk.

- The partnerships allow extensive sharing of resources and information, including discounted computing, access to data, engineering staff, and joint development of custom chips.

Now, back to the recent drama unfolding between Sam Altman and Satya Nadella. As The Verge put it, tensions are high and the relationship is “straining under pressure.” Altman is trying to limit the revenue it shares with Microsoft as it seeks to transition to a public company and exempt a planned $3 billion stock acquisition of AI coding startup Windsurf from the existing contract between the parties that grants Microsoft access to OpenAI's intellectual property. Meanwhile, Microsoft is pushing for more influence and return on its investments.

As OpenAI battles for access to more compute power and less reliance on Microsoft, tensions have been rising during negotiations over the future of OpenAI’s business and its Microsoft partnership. Microsoft backed down on being the exclusive cloud provider for OpenAI earlier this year, but OpenAI still needs Microsoft’s approval to convert part of its business to a for-profit company. That’s led to a potentially explosive outcome.

The uncomfortable truth is that OpenAI cannot run its models without Microsoft’s infrastructure, and Microsoft cannot afford to lose its foothold in AI.

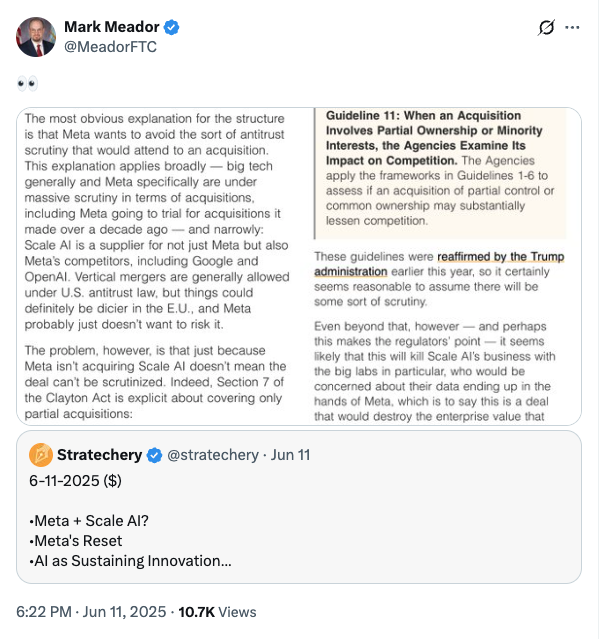

This isn’t a one-off problem. Meta’s recent investment in Scale AI shows the same pattern. Meta’s $14.3 billion investment to acquire 49% of the company. As Stratechery’s Ben Thompson put it:

The most obvious explanation for the structure is that Meta wants to avoid the sort of antitrust scrutiny that would attend to an acquisition. This explanation applies broadly – but tech generally and Meta specifically are under massive scrutiny in terms of acquisitions, including Meta going to trial for acquisitions it made over a decade ago – and narrowly: Scale AI is a supplier for not just Meta but also Meta’s competitors, including Google and OpenAI. Vertical mergers are generally allowed under U.S. antitrust law, but things could definitely but things could definitely be dicier in the E.U., and Meta probably just doesn’t want to risk it.

Meta’s move is a reset of the classic “embrace, extend, extinguish” playbook popularized by Microsoft. Scale AI gets funding. Meta gets long-term leverage over a key AI supplier.

This is the new normal: billion-dollar “partnerships” that deliver market control without triggering merger review. Last year, we warned that these deals aren’t about innovation. They’re about control. Big Tech uses financial entanglements to lock in potential competitors, capture market share, and shut out competition before it begins. Now, even the CEOs on the inside are starting to sound the alarm.

The FTC needs to continue this work, and we are glad FTC Commissioner Mark Meador is paying attention.

The FTC and DOJ need to act before it's too late. These aren’t partnerships. They’re acquisitions in disguise.